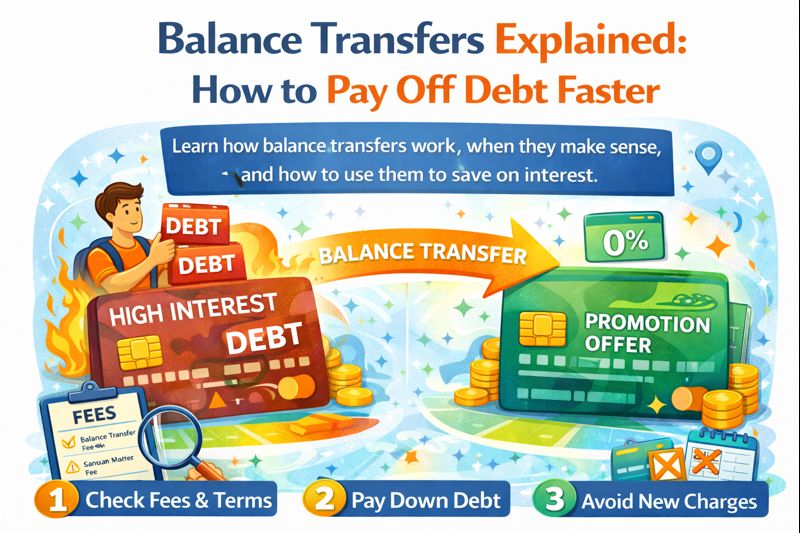

Balance Transfers Explained: How to Pay Off Debt Faster

Learn how balance transfers work, when they make sense, and how to use them to save on interest.

Learn how balance transfers work, when they make sense, and how to use them to save on interest.

If you're carrying high-interest credit card debt, a balance transfer can be a powerful tool to help you regain control of your finances. When used correctly, it can save you hundreds — or even thousands — of dollars in interest. At HelloBetterCredit.com, we believe understanding the details is key to using balance transfers effectively. Let's break it down.

A balance transfer allows you to move debt from one credit card to another — usually to take advantage of a lower or 0% introductory APR. Instead of paying high interest on your existing card, your balance is transferred to a new card with better terms.

Here's how the process typically goes:

Apply for a balance transfer credit card

Request the transfer of existing balances

The new card pays off your old card

You repay the balance under the new APR terms

During the promotional period, you may pay little or no interest

Why consider a balance transfer?

Lower interest rates

Faster debt payoff

Simplified payments

Potential savings on interest

For many people, this can make debt feel far more manageable

While interest rates may be low, balance transfers often come with fees:

Balance transfer fee: Typically 3%–5% of the amount transferred

Late payment fees: Missing a payment can cancel your promo APR

Post-promo APR: Applies after the introductory period ends

Always read the terms carefully

A balance transfer can be a smart move if:

You qualify for a low or 0% APR

You can pay off the balance before the promo ends

The interest savings outweigh the transfer fee

It's less effective if you continue adding new debt

Consider avoiding balance transfers if:

Your credit score is too low to qualify

The transfer fee outweighs the interest savings

You're likely to miss payments

You plan to keep spending on the old card

Balance transfers are a tool — not a solution by themselves

Follow these best practices:

Stop using the old card

Create a payoff plan

Pay more than the minimum

Track the promo end date

Avoid new balances on the transfer card

Discipline is what makes the strategy work

Understanding the impact:

Short term: A hard inquiry may cause a small dip, new credit can lower average account age

Long term: Lower utilization can improve your score, on-time payments build positive history

Used responsibly, balance transfers can actually help your credit

Compare 200+ credit cards and find the one that matches your needs and goals.

Browse All Cardsarrow_forward