Find Your Perfect Credit Card in Minutes

Compare 200+ credit cards from top issuers. Whether you're building credit, earning rewards, or transferring balances—we'll help you find the card that fits your goals.

Popular Searches

Browse by Category

Find the Perfect Card for Your Needs

Explore curated categories designed to match your financial goals

Student Cards

Start building credit early with student-friendly options

Business Cards

Separate business expenses and earn rewards

Secured Credit

Perfect for building or rebuilding credit from scratch

Cash Back Cards

Earn money back on every purchase you make

Travel Rewards

Earn points and miles for your next adventure

Balance Transfer

Pay off debt faster with 0% intro APR offers

Student Cards

Start building credit early with student-friendly options

Business Cards

Separate business expenses and earn rewards

Secured Credit

Perfect for building or rebuilding credit from scratch

Cash Back Cards

Earn money back on every purchase you make

Travel Rewards

Earn points and miles for your next adventure

Balance Transfer

Pay off debt faster with 0% intro APR offers

Student Cards

Start building credit early with student-friendly options

Business Cards

Separate business expenses and earn rewards

How It's Work

Get ready to buy our unique credit card

Buying a credit card from a credit card marketplace website involves browsing, comparing, selecting

Search and Compare

First, you'll need to search and compare credit cards offered on the credit card marketplace website

Select a Card

Once you've compared the different options, select a card that meets your needs and click on it for more information

Apply for the Card

If you decide to proceed with the card, you'll be directed to the issuer's website or application form to complete

Apply For Personal Account

Apply For Business Account

Apply For Worldwide Account

Why Choose Us

Why Millions Choose Hello Better Credit

We're committed to helping you make informed financial decisions with transparency and expert guidance

100% Free Forever

No hidden fees, no subscriptions. Compare and apply completely free.

Unbiased Recommendations

We show you all your options, not just the cards that pay us the most.

Expert Reviews

Our team of financial experts test and review every card we feature.

No Credit Impact

Searching and comparing cards won't affect your credit score.

Secure & Private

Bank-level encryption protects your personal information.

Real User Reviews

Read thousands of verified reviews from actual cardholders.

Learn & Grow

Credit Card Guides & Expert Tips

Master credit cards with expert insights, practical guides, and proven strategies

How to Choose Your First Credit Card (Beginner's Guide)

New to credit? Our complete guide walks you through everything you need to know before applying.

Read Full Guidearrow_right_altCash Back vs. Travel Rewards: Which Is Better?

Compare the two most popular reward types and find out which one maximizes your spending.

5 Ways to Improve Your Credit Score Fast

Boost your credit score with these proven strategies from financial experts.

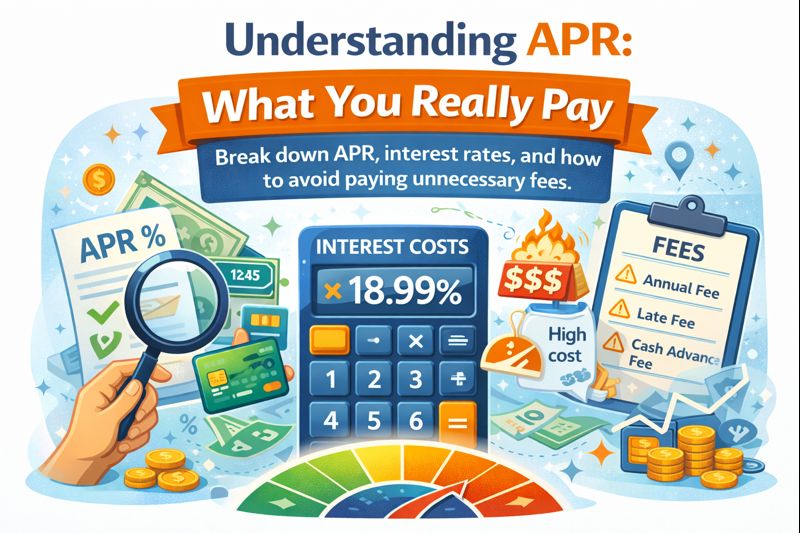

Understanding APR: What You Really Pay

Break down APR, interest rates, and how to avoid paying unnecessary fees.

Explore Topics

Find guides by category

Frequently Asked Questions

Everything you need to know about finding and applying for credit cards

Get quick answers to common questions about our platform and the credit card application process.

Each card listing shows the minimum credit score typically required. We also offer a Card Match tool that analyzes your profile and shows your approval odds—without affecting your credit.

Most applications take 5-10 minutes to complete. Many issuers provide instant decisions, while others may take 7-10 business days to review your application.

While you can apply for multiple cards, we recommend waiting at least 3-6 months between applications. Multiple hard inquiries in a short time can temporarily lower your credit score.

If you're denied, the issuer will send a letter explaining why. You can then work on addressing those issues (like paying down debt or building credit history) before reapplying.

Yes. The terms, rates, and welcome bonuses are identical whether you apply through us or directly with the issuer.

We earn commissions from card issuers when you apply and get approved through our links. This allows us to keep our service completely free for users.

Still have questions?

Our credit experts are here to help you find the perfect card